New taxes in the "other" category

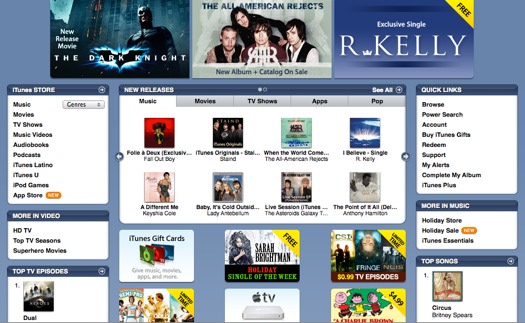

They might not be 99 cent songs much longer.

The Paterson budget plan has a whole bunch of items stuffed into a section called "Revenue Actions" -- it's kind of like a giant "other" category for the budget. Among the proposed new taxes and fees that caught our eyes:

+ The iTunes tax -- Extends sales tax to digital items such as music or text.

+ The entertainment tax -- this would extend sales tax to things like movie tickets.

+ The cable and satellite tax -- cable and satellite TV would become subject to sales tax.

+ Extend the cigar tax -- would increase the tax on cigars by about 50 percent (to 50 cents per cigar)

+ The online shopping tax -- the Paterson plan would make it easier for New York State to claim that a business has a "nexus" in the state and thus is eligible to be charged sales tax on items it sells online.

+ The starting gate tax -- would impose a $10 fee on each horse entered into a pari-mutuel race in the state.

+ Wine and beer tax -- increases excise taxes on wine from 18.9 cents per gallon to 51 cents per gallon and beer from 11 cents per gallon to 24 cents per gallon

+ Expanded bottle bill -- would extend the 5 cent bottle deposit to drinks not currently covered.

+ Civil service test fees -- would increase the fee for open position civil service exams by five dollars and would institute a new fee (from $10 to $25) for promotional exams.

None of these are a done deal, yet. The proposed budget still has to be passed by the legislature.

Hi there. Comments have been closed for this item. Still have something to say? Contact us.

Comments

Before you know it we'll have to pay a tax whenever we want to go to the bathroom.

Also, in reference to "The iTunes tax -- Extends sales tax to digital items such as music or text.", for a while now they have taxed the monthly price for online games like World of Warcraft. Not sure what that's covered by.

... said Matt on Dec 16, 2008 at 3:33 PM | link

If there is a blog reading tax, I'm so outta here. Just so we're clear.

... said Pantaloons on Dec 16, 2008 at 3:38 PM | link

I really have no problem with any of these taxes. If anything the tax on alcohol, tobacco, and soda might force people to make healthier decisions, but the net effect on most of us will be ignored in a matter of weeks. I seriously doubt any of the above curtails my already excessive consumption of these things.

... said JamesWN on Dec 16, 2008 at 4:31 PM | link

Seriously? What this says is that Davey is afraid to raise taxes on the wealthy and corporations in order to pay for the state's massive overspending, including an increase in welfare spending which was proposed in the budget. Instead he's targeting lower and middle class citizens with these regressive "revenue enhancers". Maybe he's as incompetent as SNL made him out to be after all...

I liked him until now :(

... said Erik on Dec 17, 2008 at 9:38 AM | link

Aside from the online sales tax I don't have much of a problem with them, either. Online sales are not physically conducted in the state and shouldn't be taxed (I'm not a lawyer, just someone who hates real-life shopping).

... said Lathamite on Dec 17, 2008 at 9:55 AM | link

Hmmm...I guess I'm the only one who has a problem with the sugar drinks tax...

Let me get this right...I'm healthy, not obese, have no need to drink diet soda, yet I get to pay for those who overindulge?

What's up with that man? I don't mind paying sin taxes on items that are proven to make a large percentage of consumers of said items consume more tax dollars (e.g. tobacco - health care) but sugared soda? How many of us drink non diet soda because the diet stuff makes us sick? Do we get an exemption for that?

Drinking diet is a *less* healthy decision for me. Do I send a Dr's not in with my taxes or will they issue me one, kinda like a 1099?

Or maybe it should be viewed as a 'luxury tax' to go with the one that was supposed to keep us all from buying gas guzzling cars in the 90's.

Sigh. Guess that 20 minute drive over the border to Vt. to buy gas and booze just got another justification.

... said komradebob on Dec 18, 2008 at 6:21 PM | link