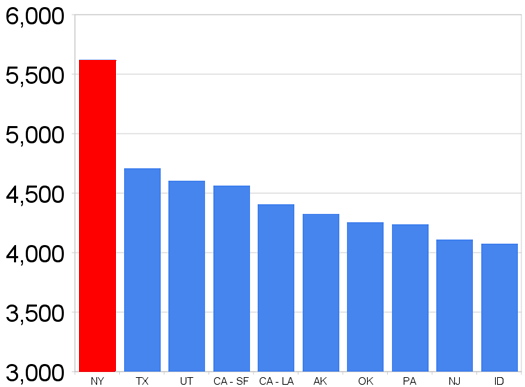

New York has the highest closing costs

The ten most expensive states (counting LA and SF separately). Arkansas had the lowest average costs at a little more than $3,000.

The closing costs for a $200,000 loan in New York State average $5,623, according to a survey by Bankrate. That's highest in the nation. (Yes, shock. This is New York.)

New York's average is way ahead of #2 Texas (yeah, not everything is bigger in Texas). The Lone Star State's average was $4,708 -- 16 percent less than the Empire State. In fact, New York's total was 50 percent higher than the national average. (Arkansas had the lowest at $3,007.)

Here's how Bankrate figures the costs break down in New York.

Of course, closing costs make it more expensive to buy a house -- but they also add to the price of refinancing your mortgage. And right now mortgage interest rates are at record lows. (Here are some tips for saving on refinance closing costs.)

[via Business Buzz]

graph based on figures from Bankrate

Hi there. Comments have been closed for this item. Still have something to say? Contact us.

Comments

Maybe it's just me, and someone can happily correct me on this, but WTF is all that money for in the title search and insurance cost. When we bought our home last year our realtor joked "so if in 1917 the guy who built this house died and his family sold it without his permission." So let me get this straight, if my house sold each and every year for it's 100 year history, every new owner has to jump through this hoop as if the previous didn't? I think there should be a carfax, for houses, and it should be optional.

Sure, the bank doesn't want to risk that you're buying a home with a risky deed, but seriously, almost $3k every time it's sold? outrageous!

... said daleyplanit on Aug 17, 2010 at 2:48 PM | link

Title insurance protects you if the person you're buying the house from (or one of the predecessors in interest) sells it to you and then turns around and sells it to someone else. It ensures your place in line for possession and ownership.

... said Katie on Aug 17, 2010 at 4:48 PM | link

Closing costs may be high, but actual property costs are low. Having grown up on the beach in Florida where I could only afford a POS "beachside," I'm still amazed at how much house I can get for the same amount here. It depends on the neighborhood of course, but I'm looking forward to buying in the area soon even with these closing costs! :)

... said Rhea Drysdale on Aug 17, 2010 at 6:45 PM | link

I think that stuff is kind of like paying protection money to the mob... If you don't pay it, someone will come along and either a) kneecap you,. or b) take your house... possibly both...

Also... High closing costs. High taxes, High cost of doing business... it's a good thing we have Crisan! :)

... said Andy on Aug 17, 2010 at 7:13 PM | link

I did a quick, high-level comparison with neighboring states. It's here: http://goo.gl/wlNp

Nothing really stands out. First suspicion might be that lawyers take a bigger cut here. After all, we're the last state to permit no-fault divorce, only because attorney-lobbies were determined to keep things complex, hence expensive, and successfully blocked change. But legal costs don't stand out here.

Next thing to suspect is a Manhattan effect, where insane costs in a global capital warp the state's numbers. But nothing sells for $200k in Manhattan.

So it's just more expensive to close in NY than next-door. Why?

I wonder if it isn't a product of what A.C. has in mind when he talks about rightsizing government. In NYS, we accept that concentric layers of government each take their user-fee cut: city or town, amorphous taxing districts, counties, and NYS itself. Each has private sector hangers-on, supposedly essential to ensuring you're square with that layer.

Could be that there's no specific bad guy, and that we pay more because our government is so heavy.

LQ

... said Lou Quillio on Aug 17, 2010 at 10:45 PM | link

@Lou: Thanks for breaking that out.

You mentioned the Manhattan effect -- and while you're right about the scarcity of 200k mortgages there, it would be interesting to see if there's a geographic difference for upstate vs. downstate. Attorneys, appraisers, surveyors -- all those people -- could have higher fees in NYC because of higher costs (rent, specifically).

There's gotta be a reason New York State is so much more expensive. It might make an interesting investigation -- by a news outlet... or even an agency such as the state AG.

... said Greg on Aug 18, 2010 at 12:43 AM | link

"only because attorney-lobbies were determined to keep things complex"

I'm not sure that's entirely accurate. Determining who is at fault is *not* the difficult part of doing a divorce (although it can be tricky, to say, prove adultery). The equitable distribution is the tricky part and where most of the attorney's fees are spent doing negotiations.

From what I saw the majority of the opposition was concerned about the spouse who stayed at home in exchange for the other spouse bringing home the bacon, as they say. The person who stayed at home gave up learning skills to support themselves and now may be stonewalled into accepting whatever equitable distritbution the one with all the money and "power" in a relationship decides is best. That's why the new divorce law has a presumption that the "monied" spouse will cover the "Non-monied" spouse's attorney's fees, and there are some temporary maintenance provisions in place.

As to real estate, downstate (Westchester, NYC, LI) are much, much more expensive. Title insurance and searches run about $6,000.00 whereas up here it's about $1000.00. Attorneys get almost $2000.00 to do a closing (which are not difficult at all) whereas up here they get anywhere from $500-1000 to do it. A lot of the other costs are based on property values which are obviously significantly higher down there. Glad I moved out of there and am taking advantage of the wonderfully low cost of living up here.

... said Katie on Aug 18, 2010 at 1:54 PM | link

@katie:

Oh, folks should judge the no-fault divorce law however they will. It's at least mis-named and perhaps misconceived, if "no-fault" amounts to no more than "unilateral." OTOH, if you stand to lose because you sacrificed career on a promise later broken, that's what lawsuits are for, and that's when your divorce should truly be a lawsuit. Not the common case, IMO, though I've been the aggrieved party in one of these. Chose to stay out of court and take the hit.

I only meant that I believe business opposition -- not principled opposition -- accounts for NYS being last. Pretty sure about that.

LQ

... said Lou Quillio on Aug 18, 2010 at 10:20 PM | link