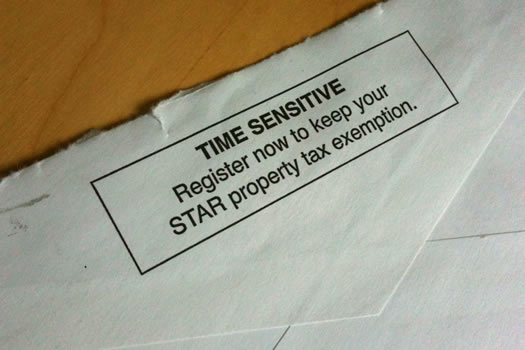

Don't skip that letter about the STAR exemption

From the boring-but-important file: If you own a home and get a Basic STAR property tax exemption (and most people do) you need to register with the state tax department by the end of this year -- or lose out on the tax break for next year. Here's the online registration link.

The registration requirement is part of legislation for the most recent state budget -- it's aimed at cutting down on people claiming inappropriate exemptions. After registering this year, it won't be necessary to register again. As the state Department of Taxation and Finance explains: "based on the information provided in the registration process, the Tax Department will monitor homeowners' eligibility in future years."

The tax department announced this week that it's sent out 320,000 letters to homeowners getting the Basic STAR exemption in northern and eastern New York, so you'll probably get a letter soon, if you haven't already. (We got ours today.) The registration requirement doesn't affect the Enhanced STAR exemption for senior citizens.

The Basic STAR exemption exempts the first $30k of the full value of a home from school taxes, so it can be worth hundreds of dollars. It's available to owner-occupied, primary residences where the resident owners' and their spouses income is less than $500,000.

... said KGB about Drawing: What's something that brought you joy this year?