Totaling up the "other" taxes

The state Assembly Republican Ways and Means Committee (apparently they had to start their own) has put together an estimate of how much increased fees and the "other category" taxes in David Paterson's proposed budget would cost "the average New York family." (We found it on Jim Tedisco's blog -- a copy is also posted after the jump.)

The state Assembly Republican Ways and Means Committee (apparently they had to start their own) has put together an estimate of how much increased fees and the "other category" taxes in David Paterson's proposed budget would cost "the average New York family." (We found it on Jim Tedisco's blog -- a copy is also posted after the jump.)

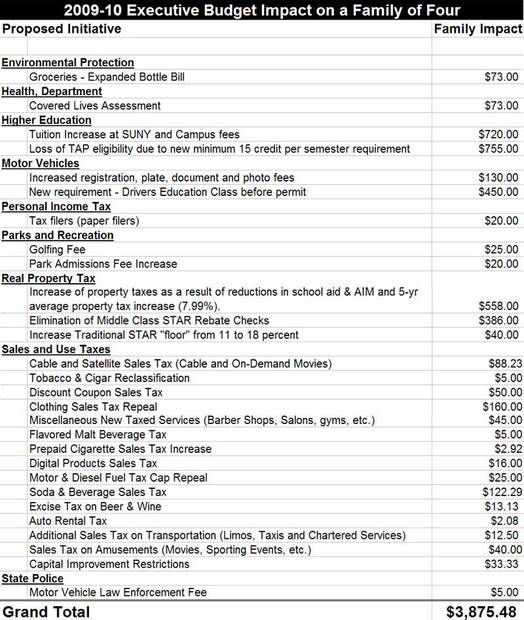

The analysis concludes that the taxes on items such as soda and music downloads will cost that average family $3,875.48 a year.

The estimate includes sub-estimates for each proposed new or increased tax. We couldn't find the math behind these estimates, so it's kind of hard to assess their validity (if you know where we can see the math, please tell us.)

You can reverse engineer some of the numbers and infer the assumptions made. For example, the estimate includes $720 in increased SUNY tuition costs -- so we're guessing this "average family of four" has at least one kid in college. It also estimates this family would spend an extra $122.29 because of the soda tax. We know that Paterson's budget includes an additional 18 percent sales tax on sugared sodas, so we worked this number backwards, too:

$122.29 is 18 percent of $679.38

If you figure a 12-pack of soda is about 4 dollars (depends on the sale), then that's almost 170 12-packs.

170 12-packs is 2040 cans of soda.

That's more than five-and-a-half cans of soda per day per year.

Here's the whole estimate -- you can get a bigger, easier to read version by clicking on it.

photo of tattered dollar: Flickr user califrayray

Hi there. Comments have been closed for this item. Still have something to say? Contact us.

Comments

That's more than five-and-a-half cans of soda per day per year.

If you correlate this to purchases of well rum, this would be closely applicable to mean levels of consumption in my household.

We're not quite a family though, and pretty far from average. If this was an estimate for awesome New York households, that would be more accurate.

... said B on Dec 19, 2008 at 11:42 AM | link

I know some of these stats sound outrageous, but, I really do know people right here in Albany who have five and a half cans of soda, per day, per year. And in the least shocking related story ever, all of those people happen to be morbidly obese. I love them dearly, but, their waistlines are bigger than the national debt. And I realize I'm being uncharacteristically serious, but, I support the soda tax. And I hope it discourages them from continuing their deadly behavior. Because no other form of intervention seems to work.

... said Pantaloons on Dec 19, 2008 at 11:53 AM | link

This is absolutely ridiculous. Where are the taxes that will place a higher burden on the rich? The governor wants to nickle and dime us into the poorhouse. Or out of the state.

... said Danielle on Dec 19, 2008 at 11:54 AM | link

What a load of crap. Most of these taxes are on discretionary items.

... said JamesWN on Dec 19, 2008 at 11:57 AM | link

We need less taxes not more of them. Tedisco's right. Cut the taxes.

... said Salt N Pepa on Dec 19, 2008 at 12:08 PM | link

Wow... I'm looking at these taxes and they seem to me to be things the MIDDLE CLASS buys. Like the lower middle and the middle middle class. (Yes, I am one of those crazy economic moralists who seperate the middle class into three stratta!) Can we all agree that the MIDDLE CLASS sustains the economy and when they are hurt the most by taxes and economic freud, the economy suffers the most?

(Alas, I was called a communist the other day for disagreeing with trickle down theory!)

... said Ellie on Dec 19, 2008 at 1:08 PM | link

There are two uncontested (i.e., valid, reliable) causes of obesity - television and sugared soft drinks. The tax on soda may seem unfair and silly, but it will reduce individual consumption, overall calorie intake and subsequently, obesity. Its unfortunate that the most effective way to address health problems is through legislation (e.g., seat belt and no smoking laws) - but people don't change their behaviors until you hit them in the pocketbook. And while, yes, the middle class does drive the economy, they are also significantly represented among the obese... and we're all paying for that.

... said Barold on Dec 19, 2008 at 1:36 PM | link

*kisses Barold photo locket*

... said Pantaloons on Dec 19, 2008 at 1:47 PM | link

Fun math problems to work on. This is the perfect activity for a snowy day. Gee, I wonder why I didn't date much in high school. Anyway...

I'm confused about the graphic's property tax increase. It seems to me that they're calculating a property tax increase of 8% over the last five years (reasonable), but then charging entire thing in the one year represented by the graphic. Besides, the school aid that was removed will not necessarily result in dollar-for-dollar increase in local property taxes. School districts are looking into ways to do all that they can with less. (Additionally, this weakens the Republicans' argument because according to their rationale in the chart, the government giving more school aid would somehow mean less property taxes, and that doesn't make any sense.)

The family's bottle bill tax assessment assumes that they drink 1460 containers of non-carbonated beverages — one per person per day. And they don't recycle the containers. This doesn't count the soda, since their daily near-six-pack of soda is already covered by the existing bottle bill! All those soda cans and bottles will need to be recycled, so while they're at Price Chopper they can recycle their non-carbonated containers too.

Five dollars in "flavored malt-beverage" tax. Am I really to believe that some family will drink $62 in Zima in a year?!

A $160 clothing tax repeal means that this family is spending $2,000 on clothing in a year. (Since the current tax exemption on clothing is on items less than $110, this assumes that the entirety of the family's new wardrobe is less expensive items.) I have no idea if that's reasonable, but I'm not one to ask. (Have you actually seen how I dress?)

I went to a private college that raises tuition a whole lot more than $720 in a year. SUNY is a very strong public university system, and students already get a whole lot for their investment. Having them pitch in a little more isn't the end of the world. Any student that is having trouble paying for college is likely already getting student loans, so it's doubtful that the tuition increase itself would prevent anyone from going to SUNY who isn't already going.

So this family has four members, one of whom is in college at SUNY, another who is exactly fifteen years old (so as to need to take a driver education class). The family plays golf, goes to state parks, drinks two cases of soda a week, smokes, drinks beer and wine, and takes about $150 in taxi or limo rides home from the bars each year. The family also spends $500 on movies and sporting events each year just in New York State. They can't be going to sporting events — I went to a River Rats game a couple weeks ago and the joint was empty. They spend $200 at the iTunes Music Store in a year (twenty complete albums). Apparently the family has cable, so Junior will be paying about $7.50 more per month for his after-hours pay-per-view movie habit.

It seems to me that any family that has this kind of discretionary income can afford a few more dollars to help the State in which they live.

I think the Republicans are barking up the wrong tree here. Fiscal conservatism is about paying for what you use and not paying for what you don't use. Paterson's plan seems to be a way to make up for the crappy budgetary hand we've been dealt in a fairly responsible fashion. If you don't like paying the cable bill, cancel your service. Don't go see movies if it's too expensive. Start drinking water instead of sugared sodas. Quit the Zima.

I hate taxes too, but when it comes down to it our government programs need to get paid for. It seems that Republicans have been pushing a lot harder to reduce taxes than to reduce spending. If a Republican can come up with sensible ways to cut back some government programs that the populace decides we can live without, I'm all for it. Until that time, the government's programs need to be paid for somehow. This family can do their part.

... said James Cronen on Dec 19, 2008 at 2:14 PM | link

Oh come on Cronen, you can't expect people to cancel their cable. Why, that's positively unamerican! Go back to Canadia or whatever other European country you're from!

... said B on Dec 19, 2008 at 2:38 PM | link

You can also infer that this "average" family with the college student isn't going to school full time. Tedisco's just an alarmist, the odds that any family, let alone the average family, would be unlucky enough to hit every one of these taxes is absurd.

It's true though, these taxes do disproportionally affect middle and lower income folks and that's just a shame. Still though, I don't think Paterson really wants these to get into the final budget. I think just like any good liberal he supports the rich people tax; politically though I think he'd just rather not have to be the one to propose it.

... said Jackers on Dec 19, 2008 at 3:07 PM | link

Let's call this "Exhibit W" in case of why people are fleeing NY like the plague and spending their hard earned dollars elsewhere.

... said James on Dec 19, 2008 at 3:12 PM | link

There is a lot of items on Paterson's list that we don't have to take part in. Why, we might even succeed in prolonging the recession in New York by keeping our money in our pocket!

I went through the list and found 16 items I can definetly say I will avoid.

The idea of spreading the program cuts around is missing the point: The higher incomes SHOULD be taxed slightly higher. They can afford it, to help overall. They aren't going to move--A doctor won't give up his practice, nor will a high paid state worker leave his high paying job. That is malarkey.

With all the griping going on, no one comes up with concrete, reasonably alternatives to Paterson's suggestions. It is just no, no, no, don't touch my favorite. Everyone must share the pain.

... said Al Olsen on Dec 19, 2008 at 3:19 PM | link

If you are looking to make people healthier by taxing them why create a golf fee and have/increase taxes on gyms? Park fee going up too! Give me a break... no literally, cut some taxes!

... said Gary on Dec 26, 2008 at 8:15 AM | link