Maybe all those new apartments are starting to have some effect on rents

Downtown Albany has been hot spot for new apartments in recent years.

A sort-of follow-up to the recent post about all the apartments the Capital Region has been adding the last few years (with many more in the pipeline)...

Capital Region rents have been on an upswing during the past half decade, but that increase appears to have flattened during the last year. That's one of the bits from the new Capital Region multi-family market report published by Sunrise Management & Consulting.

Sunrise president Jesse Holland in a press release: "The data indicates that the market is getting saturated ... Everyone wants to know if the time to build more apartments is over, or if the economy is going to take off."

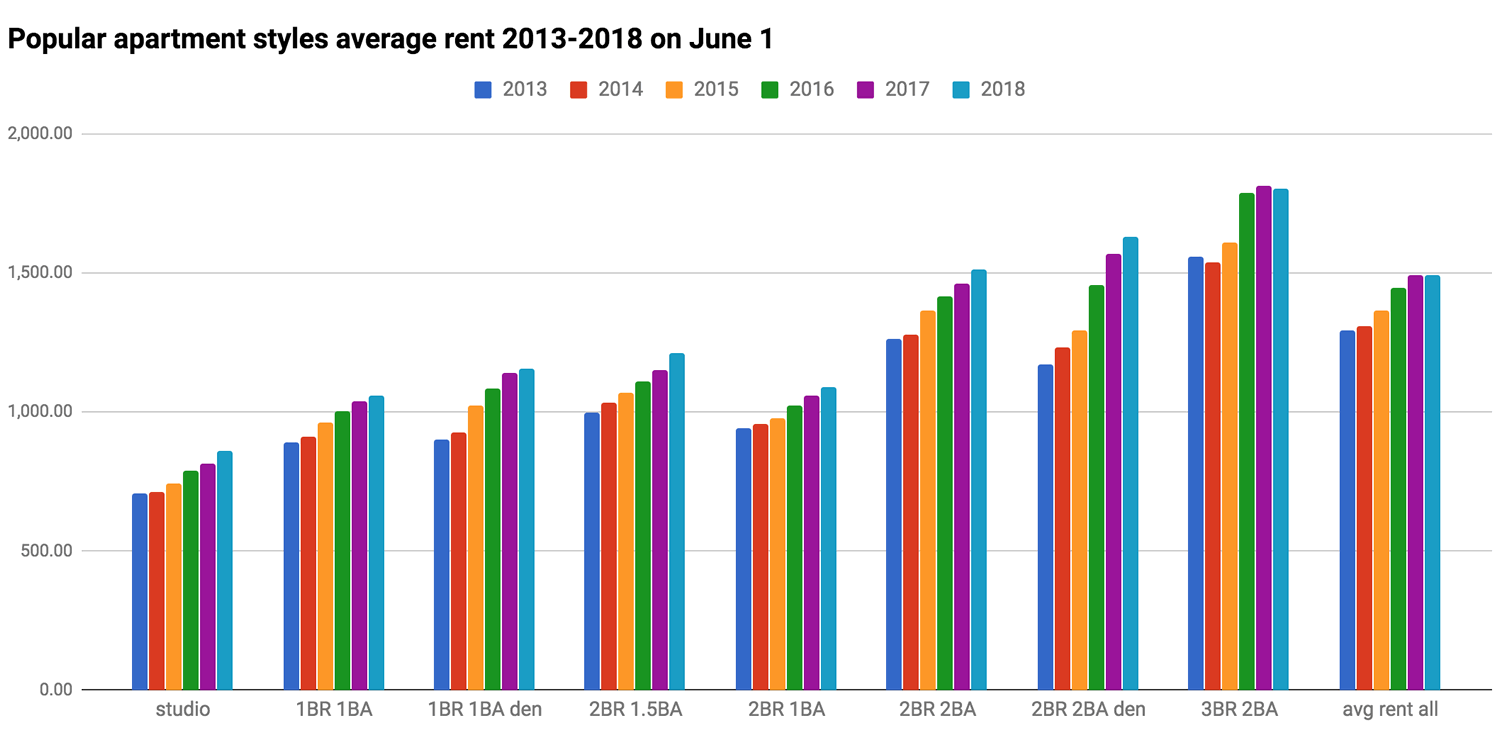

A chart (because of course) and a few more interesting bits from the report...

About the numbers

The Sunrise report is based on a survey of 175 market rate rental properties in the Capital Region with no income or age restrictions and does not include student housing. Those properties collectively include 32,661 units -- with an average number of units per property of 187. The smallest property includes 22 units, the largest 952.

Also: The rent prices are asking prices, not actual rents, so they don't include concessions.

So that's a big pool of local apartments, but it's not comprehensive. And it doesn't cover smaller properties like the ubiquitous two-flat buildings.

For some very wide angle perspective: In the Census Bureau's American Community Survey 2016 1-year estimates (the latest available), the median gross rent for renters in the Albany-Schenectady-Troy metro area was $931 (+/- 21).

2018 averages

For the units included in the survey, the average unit was 1,287 square feet with an asked rent of $1,457.66. Sunrise works that out to an adjusted average rent per square foot of $1.11.

As tends to be the cases with houses, the price per square foot was larger for smaller places and smaller for larger places. Example: The per-square-foot price for 1BR/1BA units (765 square feet) was $1.31. For 2BR/2BA units (1197 square feet) it was $1.21. (Bathrooms and kitchens tend to be more expensive per square foot than bedrooms or living rooms.)

The last half decade

Between June 1, 2013 and June 1, 2018, the Sunrise reported average rent increased 15.39 percent. But between 2017 and 2018 it declined slightly (a quarter of one percent).

There's a graph at the top in large format that depicts the Sunrise reported figures for a handful of popular unit types and the overall average -- click or scroll all the way up.

For some inflation perspective: $1 in 2013 had the same buying power as $1.07 in 2018.

For some income perspective: The median household income for the Albany-Schenectady-Troy metro increased a little more than 10 percent between 2013 and 2016 (latest available), according Census Bureau American Community Survey 1-year estimates.

More coverage

This report was released as part of an industry event in Latham last Friday. Mike DeMasi as a write-up about that. [Biz Review]

Earlier

Say Something!

We'd really like you to take part in the conversation here at All Over Albany. But we do have a few rules here. Don't worry, they're easy. The first: be kind. The second: treat everyone else with the same respect you'd like to see in return. Cool? Great, post away. Comments are moderated so it might take a little while for your comment to show up. Thanks for being patient.

Comments

I hear people complain sometimes about "all the apartments they're building" but I am glad that the market is getting saturated because that's a main factor both in high housing costs and in gentrification, both conditions which are really symptoms of poor housing policies.

... said Justin on Jun 11, 2018 at 4:36 PM | link

Interesting that they see an overall decline in rent during past year while only one group - 3BR - actually went down. Must be a very 3BR heavy sample. On the other hand, none of latest Albany projects are 3 BR heavy, some are 1BR and 2 BR only.

Looks like not actual set of apartments was analyzed, but available listings - with low demand group being overrepresented.

... said Mike on Jun 12, 2018 at 8:10 AM | link

@Mike: The report lists something like 25 different apartment unit types -- everything from studio all the way up 4BR (there are a bunch of different configurations in between when considering bathrooms and whether there's a den). And the unit-specific rental data appears to be drawing from a much smaller overall pool of units. That's one of the reasons I pulled out just a few of the most popular unit types. Like all these numbers, it's worth taking them with a grain of salt for their limitations and what they are. They're probably best interpreted as a way of getting a sense of overall direction.

... said Greg on Jun 12, 2018 at 8:24 AM | link

@Greg - I still think it is telling that out of 8 most popular types (and I agree, those are most popular), 7 did go up during past year - yet the claim is that overall price went down.

... said Mike on Jun 12, 2018 at 10:18 AM | link

Unfortunately market saturation can also lead to empty buildings, failures and eventually abandonment which leads to blight and then we are left with self created poor housing policies.

Its like the Casino benefit scam, its a shell game. They build brand spanking new apartments and siphon renters off of the existing pool. The demand is not driving the supply. These buildings are not being built for people who struggle to find affordable housing they are targeting the same groups. It will drive rents down in existing buildings based on perception that newer is better. In the long run having no lasting benefit.

... said Steve on Jun 12, 2018 at 12:40 PM | link

"These buildings are not being built for people who struggle to find affordable housing they are targeting the same groups. It will drive rents down in existing buildings based on perception that newer is better. In the long run having no lasting benefit."

@Steve it seems to me that driving rents down in existing buildings will help people who struggle to find affordable housing. The lasting benefit is that housing prices will decline (or the pace of increase will slow) for everybody. The only way to increase housing affordability is to continue to encourage more housing supply.

... said Argus on Jun 12, 2018 at 1:15 PM | link

@Argus

Your math works in theory, unless you are a landlord. Whos costs increase while rents are driven down. Then costs are cut other places, upkeep declines, neighborhoods deteriorate. We end up moving blight around pushing the pieces around the board, not solving the issue. These projects are not designed for families or working poor.

... said Steve on Jun 12, 2018 at 9:19 PM | link

Over saturated? WE ARE JUST GETTING STARTED!

... said Area Developer on Jun 14, 2018 at 8:13 AM | link

Lol my thoughts exactly. I just returned from a trip around New England and was completely blown away by all the cities and towns I visited. The vibrancy and improvements in places like Portland ME, Providence RI, Portsmouth NH, Newburyport MA and even second tier place like Worcester MA blew me away. Albany can and will improve....I hope....someday-while I’m alive. This is just the beginning!

... said BS on Jun 14, 2018 at 2:00 PM | link

Steve: So what do you think happens if nothing new is built? Surely the existing poor-quality housing stock does not improve. One might be able to argue that landlords should improve the quality of their units to compete with new, or newer, housing.

... said Peter on Jul 17, 2018 at 7:06 PM | link