Sweeter than the soda tax?

Despite the impassioned and persistent efforts of the state health commissioner, the soda tax has reportedly gone flat.

Despite the impassioned and persistent efforts of the state health commissioner, the soda tax has reportedly gone flat.

But New York apparently still needs the money. And it probably doesn't need the calories.

So here's a potentially sweeter idea: instead of specifically taxing sodas that contain sugar, New York should tax high-fructose corn syrup.

A bad taste

While you (or someone) might regard the soda tax as an admirable idea, there are a lot of problems with it -- some practical, others philosophical:

+ The beverage industry has a lot of money (it's a $110 billion industry) and it knows how to spend it on legislators.

+ The idea doesn't poll well with the general public -- especially when it's framed as a "fat" tax (that sounds like someone's going to show up at your door with calipers, demanding money).

+ It targets a specific food, which opens the "well, why not cheeseburgers and ice cream" argument. Foodies aren't fans of this approach, either -- who wants the government picking what goes on your plate? And even though soda consumption has been pegged as a culprit in obesity, when consumed moderately it's probably not going to make someone fat.

+ People in lower income brackets tend to drink more soda. A soda tax would probably be regressive.

This could be sweeter

A tax on high-fructose corn syrup (HFCS) potentially would address some of these problems:

+ The HFCS industry has long argued that its product and sugar are basically interchangeable. But there's some research that indicates HFCS may be metabolized differently -- and that it could be more fattening than regular sucrose. A lot more research needs to be done, specifically in people -- not just rats. (The rise in obesity and the rise in the use of HFCS in this country could just be concurrent, not necessarily linked.)

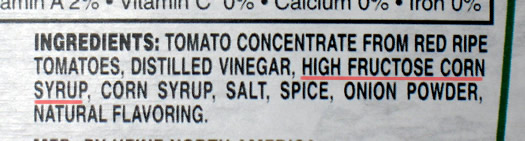

+ The tax wouldn't target a specific food, but rather an ingredient. There's precedent for regulating specific food ingredients, especially artificial ones like HFCS. A handful of municipalities -- including Albany County -- already have bans on trans-fat. This approach may sound like that kooky attempt to ban salt in restaurants -- but HFCS and trans-fat are not salt. Salt is a basic nutrient that occurs in nature. HFCS and trans-fat came from a lab.

+ Sure, the tax would increase the price of soda (soda is basically water and HFCS) -- but the industry could always switch back to... regular sugar.

+ Foodies would be on board. There's a reason people go hunting for kosher-for-Passover and Mexican Coke (hint: no HFCS).

+ Foodies would be on board. There's a reason people go hunting for kosher-for-Passover and Mexican Coke (hint: no HFCS).

+ An HFCS tax would be like a reverse corn subsidy. The federal government spent more than $2 billion on direct corn subsidies in 2007 -- and no, most of that money did not go to New York (the Empire State's total was $24 million). Subsidies have skewed the economics of food in this country so that much of the modern diet rests on a foundation of corn. While it's unclear if that's directly led to people getting heavier, the subsides do seem to have fattened the wallets of companies such as Coca-Cola.

+ The soda tax was projected to generate $1 billion a year for New York. Given that HFCS is in just about everything, a tax on it should be able to generate something along those lines. And at a billion-plus per year there should be some money available to fund programs to counter some of the regressivity of the tax -- stuff like the Veggie Mobile or start up money for grocery stores in food deserts.

OK, well...

That said, an HFCS tax is not without significant problems:

+ The beverage industry probably will be less than enthused -- and Big Agriculture is waiting ringside, ready to be tagged in. That's formidable duo to take on.

+ The most likely substitute for HFCS is... sugar. And too much of that isn't healthy, either.

+ A tax structure for HFCS might be tricky. A lot of food is produced outside the state, so it might be hard to tax the raw ingredients directly.

+ This is yet another tax -- and it's not like New York State really needs another one.

+ While all the stuff about sticking it to the corn subsidy might sound good, it's probably a reach to say that New York can turn the tide on this issue (those states in the middle get two US senators, too). The result: we just end up paying higher taxes (though, maybe, also eating fewer calories).

Still, as we've seen with the recent rattling about sodium, public pressure from high-profile government entities can push things in a different direction. And outside of Archer Daniels Midland and Coca-Cola, there probably aren't many people who are actually in favor of high-fructose corn syrup (we're pretty sure it doesn't have a fan page on Facebook).

The stuff is in seemingly everything (really, go look at the ingredients of stuff in your fridge or pantry). It's in there because it's cheap. Maybe it wouldn't be such a bad thing to make it more expensive.

Earlier on AOA:

+ If the state budget was a video game

+ It all adds up

+ How many calories does that cost?

+ New York's fattest counties

photo: Flickr user Tom Coates

Hi there. Comments have been closed for this item. Still have something to say? Contact us.

Comments

Here's something else NY could tax: politicians.

... said ethan on Apr 30, 2010 at 2:33 PM | link

This is stupid.

It doesn't make a lick of sense to massively subsidize corn production on one end and then Tax the hell out of it on the other. The people who are massively in favor of HFCS are the people that matter, namely Congress, who provide billions of dollars every year to boost its production.

that said, the problem with new york isn't revenues, its expenditures. You're not helping anyone by suggesting that NY raise taxes

... said ike on Apr 30, 2010 at 3:08 PM | link

this was a well crafted article. Good to see you looked at both sides, not just saying tax this instead because I said so. Like you said, while a lot of sugar isn't good for you, I bet it is a lot better than a lot of HFCS. And I believe one of the soda companies, possibly coke, did a special product around The Super Bowl where they removed HFCS and replaced it with sugar. They went the retro angle instead of healthier.

Again

kudos

... said dan on Apr 30, 2010 at 3:23 PM | link

I think it's a good idea to look at HFCS.

I think it's a bad idea to target it -- or anything -- just because the revenue is needed from somewhere.

If this is going to be a "good for you" measure it really should be because it's good for you, not because NYS needs the money. And it's true, there is way more HFCS out there than there needs to be, and a huge part of that is due to corn subsidies and the corn lobby. It's not even a question of what to replace it with; in many cases, HFCS is in a product just because it can be, since a producer convinced a food manufacturer to buy and use it. Really, corn syrup in hot dog buns and the hot dogs that go in them?

There have been many summaries of this that are better than anything I can say. But while i think casting a critical eye to HFCS usage is a great idea, it should be done just because it's a great idea.

As for the tax, I think its regressive nature is the biggest factor going against it. Foods with lots of corn products and HFCS in particular are cheap because of the economies involved. In most cases, people don't buy foods with HFCS over the same foods without or using sugars because they like them better but because they're cheaper -- sometimes dramtically. Well, with the exception of the case of my roommate and ketchup. But the point is, this would really hit those in the lowest income brackets very hard, especially since they may not necessarily have easy access to any alternatives (which is even a bigger issue, but a digression).

... said b on Apr 30, 2010 at 3:48 PM | link

The tax proposed this year actually was a syrup tax, although limited to syrup used in artificially sweetened beverages. This is opposed to last year's tax proposal, which worked as a sales tax.

Daines made a great point at the health budget hearing in response to some grandstanding legislators using hyperbole to talk about taxing everything that could make you fat, or even fat people themselves. He said, and I'm paraphrasing here, "it's true, artificially sweetened beverages are not the only thing that make people obese, and not everyone who drinks them is, or becomes, obese. But unlike other products that contain high amounts of sugars and fats, these sweetened beverages contain absolutely zero nutritional value. They are essentially sugarwater."

The point was that although they'd like to do whatever they could to make people consume less fattening foods; they didn't think it was a good policy to reduce fatty food consumption if it may also reduce consumption of proteins, and other essential vitamins and minerals that people actually do need for healthy nourishment. Combine that with the overwhelming statistical evidence linking artificially sweetened beverages with obesity and you have an opportunity for a smart, targeted, policy to improve public health, and raise funds to pay for all the health care expenses that these two-liter chuggers are inevitably going to need the state to pay for.

... said Jackers on Apr 30, 2010 at 4:24 PM | link

2 things.

1: the tax would have doubled the cost of Gatorade, the one sugared drink that I do drink because there is nothing else that is as good for cycling or many other athletics. I don't agree that there is no nutritional value, and if you're going to tax things with no nutritional value, there are plenty of targets.

2: We had a soda tax before. It was repealed in 1995. It didn't make anyone less obese.

... said CJ on Apr 30, 2010 at 6:51 PM | link

It won't make anyone thinner, just poorer.

... said James on Apr 30, 2010 at 10:47 PM | link

If you believe that soda has nutritional value, despite the fact that that every legitimate doctor,nutritionist, and public health official the world over disagrees, well... I guess you're entitled to your own opinion. However, you are not entitled to your own facts. "the tax would have doubled the cost of Gatorade."? I don't know where you came up with this. The tax would add about 1 cent per ounce to the cost soda (i.e., 12 ounce can of soda, 12 cents in tax). I don't know anywhere you can get a can of soda for 12 cents, which you would need to have the effect of doubling the cost. Gatorade has less than half the sugar of an equivalent amount of soda, meaning if you can find a 6 cent bottle of Gatorade then you'd be right, the tax proposal would double the cost of Gatorade.

... said Jackers on May 3, 2010 at 1:41 PM | link

I got it from this article, which was widely covered and reported elsewhere:

http://www.nypost.com/p/news/local/drink_mix_tax_sucker_punch_V1a2bOZZNjmAwjALVu8p7O

Lots of things have no nutritional value. Does that mean we should tax them? How much did consumption decrease when we previously had a soda tax?

... said CJ on May 7, 2010 at 2:29 PM | link