Comparing Capital Region property tax rates

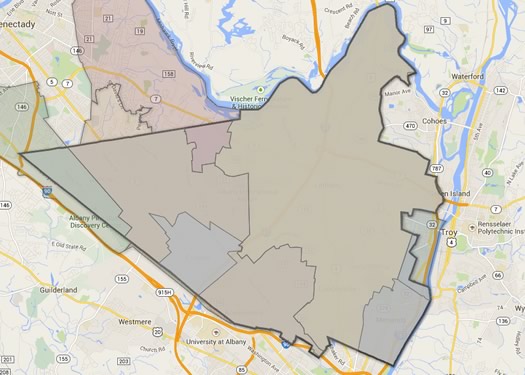

This map doesn't really show anything beyond how complicated listing tax rates can become. As you know, the bold-outlined area is the town of Colonie. Each of the sections within the town depicted above have a different entry in the tax rate listing because of some different combination of town, village, or school district.

The cities of Schenectady and Albany have the highest property tax rates in the Capital Region, according to numbers shared this week by the Empire Center.

The tax rates are for 2013 and include county, city/town, village, and school district taxes. The think tank also figured median tax rates by region around the state. And in that category, the Capital Region did well -- it had the state's lowest median at $24.68 per $1,000 of value. (The Empire Center didn't include New York City or Nassau County on Long Island in that review.)

As has been highlighted in years past, there's wide variation in tax rates around the Capital Region.

Here's the whole list, sorted and ranked...

The list

It's above in large format -- click or scroll all the way up.

Details

+ The tax rate figures are via the Empire Center, which gets them from the state comptroller's office. That link includes an interactive comparison tool.

+ The rates are "full value" tax rates and don't include things like the STAR exemption.

+ Both median home value and percent of people in poverty figures (percent of people who were living in poverty during the past year) are from the Census Bureau (2013 ACS 5 yr). They're estimates, and in the case of the smaller municipalities, the margins of error can be big -- so something to keep in mind.

A few things

Schenectady and Albany

That the cities of Schenectady and Albany top the list of total tax rate isn't surprising -- that was the case a few years back, and there hasn't been any reason to think it would have changed in the interim. But a few things thing we noted when looking over the numbers for both:

+ Albany had the highest school district tax rate in the Capital Region core at $25.55 per $1000.

+ Even though Schenectady has by far the highest tax rate -- almost $2 more per thousand than Albany -- it also has a relatively low median home value. So the taxes on a median value home in Schenectady would be about $5000, compared to Albany where it'd be about $7300.

Niskayuna

Niskayuna has both a relatively high combined tax rate (18th in Capital Region) and relatively high median home value, resulting in the highest tax total on a median home in the Capital Region core -- $8,004.

Saratoga County

The ranks of the lowest tax rates in the Capital Region are dominated by Saratoga County municipalities. Capital's Jimmy Vielkind recently looked at how towns there -- Edinburg, specifically, which has the lowest tax rate upstate -- have kept taxes low. One of the factors at work: Saratoga County has a relatively low number of people living in poverty. (See also: Household income and poverty rates in New York State -- and how Saratoga is different from the rest of the Capital Region.)

Other considerations

All these places aren't the same type of apple. You might even say some are pears. And this listing doesn't take into account services provided by municipalities.

Also: As was pointed out by multiple people the last time we wrote about these tax rate rankings, a lot goes into the choice of where to live (Rich's comment is a good example). And some of the costs of living in a place aren't as immediately noticeable. Example: How much do you spend on commuting, both in money and time? And are you willing to tradeoff some of those costs for lower/higher taxes?

Earlier on AOA: Is Albany getting the short end of the stick?

Hi there. Comments have been closed for this item. Still have something to say? Contact us.

Comments

What's not being addressed here is the taxes haven't changed, though the house values have plummeted. The amount of taxes paid on the house I live in (I am not the owner so I am not going to go into detail) are the same $ amount for tax year 2014 as they were for 2008 when the house was bought - but the value of the house is significantly less were we to sell it today. Schenectady is suffering due to so many abandoned properties (and the fact that GE, Union College, and Ellis Hospital do NOT pay any taxes), so people are being gutted by property taxes on valuations that are no longer valid for their homes. It's a total rip-off and should be considered a crime.

... said xina on Mar 18, 2015 at 8:42 PM | link

There is no practical reason for supporting two school districts in the City of Troy. Immediate savings would be achieved through consolidation.

... said Mary on Mar 19, 2015 at 10:39 AM | link

I agree, Xina. The fact is that some so-called "non-profits", like hospitals and universities, where employees are some of the best compensated in the labor market, get away with paying zero taxes and using more public goods than any homeowner. Corporations hire legions of lawyers and accountants to skip their tax obligations. Someone has to end this non-profit and coprorate rip-off and make everyone pay taxes, and by everyone I mean, EVERYONE!

... said Joe A on Mar 19, 2015 at 11:21 AM | link

I think the 'full value tax on median home' is the more telling number. After all, what good are low taxes if you can't afford the home in the first place? To purchase a median home in Schenectady, with taxes and mortgage, would be approximately $960 per month. A median home in Clifton Park would cost almost twice that, at $1800. You can just look at the tax rate and say 'Clifton Park's taxes are half that of Schenectady', which is true, but that's also only half the picture.

... said theshakes on Mar 19, 2015 at 11:23 AM | link

@xina -- I feel your pain. I bought my little house in Albany at the height of the housing market and surely have lost tens of thousands of dollars in resale value even though I've put in tens of thousands in improvements. But the problem in lowering our taxes is that the cost of city services has not decreased. Joe A. above is right. So long as so-called non-profits pay next to nothing and in Albany gov't entities pay nothing, we home owners are screwed. And yet this is the bargain with the devil I made with eyes wide open. I'm not moving to a low tax state or a lower tax region in NYS. I have figured out my financial strategies to pay my tax bills as a now senior citizen so I don't have to move out of a city I rather enjoy.

... said chrisck on Mar 19, 2015 at 11:54 AM | link

The non-profit status should only be granted to organizations that survive exclusively on donations and only use volunteer labor. If there's money for payroll, or fat savings in "trusts" etc, then there's money for taxes.

... said Joe A on Mar 19, 2015 at 11:56 AM | link

And that, by the way, would lower everybody else's business taxes as well.

... said Joe A on Mar 19, 2015 at 11:58 AM | link

@xina

If the market value of the house you live in has gone down it is up to the homeowner to grieve the assessment (which is based on the market value but is not necessarily identical to the assessed value) at the Board of Assessments for that area during the grievance period (typically starting in May). They Assesment board doesn't lower your assessment automatically. Comparable home sales from the last 6 months/year can be used to make your case. It's vey easy and at least in Albany the people in the Assessor's office are quite friendly and helpful. Absolutely worth 5 minutes of the homeowner's time.

... said Rebecxa on Mar 19, 2015 at 12:48 PM | link

Grieving one's taxes is definitely an option, but it is NOT easy. Here in Schenectady they make it as difficult as possible and the window to do so is very, very small. So if you're in the long line to grieve your taxes and the window closes, you're screwed. I also find it absurd that if the city is valuing your house at less than what they're taxing you for it, they should be responsible for managing how much taxes are collected. You can be damn sure if it is the other way around, home owners owing taxes, there is no waiting around that's done. It's like everything - if the government owes you money, good luck! IF you owe the government money, they're on you like white on rice. The homeowner of the home I live in just now qualifies for senior citizen STAR tax rebates. We're moving this year to another state. It will be interesting to see what the house sells for vs. what it was bought for - certainly the taxes and the wretched schools are 2 obstacles. The one thing we have going for us is that the house is absolutely beautiful and right on the line of Niskayuna in a really great neighborhood - close to amenities and transportation. We're going, it's not a question of if, but when.

... said xina on Mar 19, 2015 at 1:33 PM | link

Property tax can be a steady and reliable revenue source for local government. But because it's not necessarily based on one's ability to pay, property tax is not seen by many as a fair way to determine one's share of the local tax bill. And property tax is a major piece of most residents' overall tax picture.

Let's hope that proposals for a property tax circuit breaker, based on income, get some traction this year.

... said Bob on Mar 19, 2015 at 2:18 PM | link

Here's what I find interesting: (I'm a former Albany NY resident and still have an interest) I pulled up a property I'm familiar with and the tax rate appeared to be triple or quadruple of what I'd be seeing out in Seattle. I realize Albany has higher taxes than some cities in NY, but everything I've found on line seems to imply that it would be less than double, at most. I wonder how they're calculating it.

... said C Swazey on Aug 20, 2015 at 7:01 PM | link

The property tax rate in upstate NY is a travesty. I guess because there is little to no industry left here there is no source of wealth except to pick the people's pockets to keep paying high priced state workers and pensions and healthcare. It is such a joke that "private" industry here is nothing more than the recirculation of money that was probably created over one century ago into the system with what little wealth that still exists here..... it's like A Soviet block country without the benefits... unless you are like everyone else here either on the take, the dole, the state payroll, the state pension system etc. New York is a dying state.... on life support.... last one out turn off the lights.....I AM SERIOUS....

... said BS on Aug 21, 2015 at 9:59 PM | link

Bob--property tax based on income rather than property value would be (1) cumbersome for the municipality and (2) unfair. If a person makes a "big" salary but chooses a modest home why should his/her property tax be based on income?

We do realize that removing tax exempt status for hospitals/universities would eventually result in the state providing the services, which means the property would still be off the tax roll, right?

... said CAOD on Aug 23, 2015 at 6:03 PM | link

Great spreadsheet that I have used many times for clients. However, i think it would be even more helpful to create an alternate spreadsheet based on average local mortgage payements for each school district. For example, a 1,500 mortgage payment in saratoga county is going to give you a much higher purchase price than the city of Albany. My clients were often stunned that a 1,500 mtg could get you a 200k house in one area but only a 150k house in other areas.

For whatever reason, the industry rarely points this out to new home purchasers. In my experience, people want the most bang for their buck. I've gotten clients into 375k homes when their bank approval was only for only 300k just by proving that their mortgage payments would be the same for properties only several miles away.

A spreadsheet based on monthly mortgage payment of 1,500, 2,000 and 2,500 would be infinitely helpful IMO.

... said J A on Apr 11, 2016 at 11:43 PM | link

I don't see the village of Schuylerville, do they not have a separate tax jurisdiction?

... said mike on Jun 18, 2017 at 7:52 AM | link