Comparing the latest batch of Capital Region property tax rates

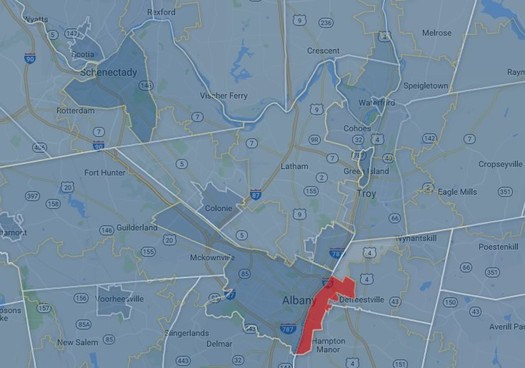

A clip from a map of the Capital Region's various overlapping tax areas -- counties, cities, towns, villages, school district. There's a larger, zoomable version after the jump. (And Rensselaer's marked in red because of missing data.)

The cities of Schenectady and Albany have some of the highest property tax rates in the Capital Region.

Saratoga Springs, Bethlehem, and Niskayuna have the highest estimated monthly payments for a median home.

Those bits are from our latest scan of Capital Region property taxes -- the numbers for the year 2015 are now out.

So, let's have a look.

Look up for tables and a bonus map

Two tables of tax and home value figures are above in large format -- along with a bonus map -- click or scroll all the way up.

Important details

+ These tax figures are from the state comptroller's office. If you'd like to access the data in an easier format, the Empire Center publishes that same data from OSC in a database with a web interface that allows comparisons between different municipalities and includes regional info.

+ The rates are "full value" tax rates and don't include things like the STAR exemption.

+ The median home value figures (the point at which half the homes in a municipality are estimated to be valued higher, and half lower) are from the Census Bureau (2014 ACS 5 yr) -- and they're from 2014, the latest year available. Also: They're estimates, and in the case of the smaller municipalities, the margins of error can be big -- so something to keep in mind.

+ The mortgage payment figures are calculated based on a 30-year fixed-rate mortgage at 3.375 percent, with a 20 percent downpayment. (So, the loan is for 80 percent of the estimated median home value.) It does not include insurance payments or anything else.

+ The "estimated minimum household income for median home" is calculated as the annual income that would be necessary for the monthly mortgage and tax payment to be equal to 28 percent or less of household gross income.

(This is one of the typical standard guidelines. Another looks at all debt a household has -- student loans, car payments, credit cards -- and aims for 36 percent or less of household gross income.)

+ There are all sorts of ways that these figures might not matchup with an actual situation. (For example: actual property taxes are based on assessments of property values by a municipality, and those assessments may vary in how closely they track home values estimated by the Census Bureau.) These numbers are, at best, a rough way to compare different places. And in any specific case, you're going to want to run through the actual numbers involved.

A few things

Tax rates versus estimated yearly taxes

The city of Schenectady is again at the top of the property tax rate rankings -- noticeably higher than other places. But when you look at the estimated yearly property taxes for its "median house" ($6,147), it ranks just 59th in the Capital Region because of a relatively low estimated median home value ($116,700).

By the way: Schenectady mayor Gary McCarthy said earlier this summer he's expecting property taxes to go down 10 percent in 2017 because of city revenue from the Rivers Casino project. [Daily Gazette]

School taxes

Municipal budgets get a lot of attention because of property taxes. But what some people maybe don't realize is that school taxes usually represent a larger portion of an overall tax bill. The Schenectady and Albany school districts top the Capital Region chart for highest rate at more than $27 per thousand of valuation. (It should also be noted that both districts serve large portions of students living in poverty.)

What it costs to live there

Of course, taxes aren't the whole story about what costs to live in city, town, or village. The municipalities with the highest estimated "median home" monthly payments (mortgage + taxes): Saratoga Springs ($1,627), Bethlehem ($1,609 and $1,580), and Niskayuna ($1,575).

The median home in all three of those places would require a household income of around $70k per year to be considered affordable by one of the typical standards.

In case you're wondering: The estimated median household income in the Albany metro area for 2014 was $61,841.

Not all places are alike

That should probably go without saying, but not every municipality or school district offers the same amenities, services, or experiences, which isn't necessarily reflected in these sorts of numbers. Nor do these sorts of numbers reflect other expenses -- for example, the cost of commuting from a home to wherever you work. And the sort of house you can get for, say, $175,000 in one place isn't going to be what you can get in another.

All that's to say, the choice of where to live -- and why -- is complicated. This is just one way of looking at it.

Earlier

+ Comparing 2013 Capital Region property tax rates

+ A few more bits about the potential sale of a chunk of the Harriman State Office Campus

(One of the goals of this sale is to add taxable land to the city of Albany.)

+ Is Albany getting the short end of the stick on state aid?

+ Ask AOA: Which school district should our family pick?

+ Ask AOA: Tips and advice for contesting a property tax assessment?

Hi there. Comments have been closed for this item. Still have something to say? Contact us.

Comments

The sad truth of Schenectady and Albany is that people wont move there until they get tax rates down. I live here and whenever I encourage people to move here that's the first thing they say.

... said Steve on Aug 18, 2016 at 8:30 AM | link

I don't need fancy graphs and pictures to summarize upstate NewYork taxes......4 words can summarize....."they are criminally high"....end of story......here come the replies "yeah but I get garbage pick up" "we have great volunteer fire departments" "our schools are wonderful".......

... said Bs on Aug 18, 2016 at 6:51 PM | link

This chart is very helpful for those looking to be new homeowners to get a better feel of what they need to pay annually on taxes that are usually included in their mortgage payments along with homeowners insurance premiums. Albany and Schenectady are among the top rates.

... said Erik Lachance on Nov 14, 2016 at 3:32 PM | link

While you have diligently tried to provide a good data, I think it would be helpful to add a column noting services paid by property taxes and those paid by special district charges not included in tax rates. For instance, City of Albany resident enjoy a professional fire department paid with property taxes. Almost all, if not all, suburban towns collect special district charged in addition to property taxes, that suport volunteer firefighters.

... said Carolyn on May 25, 2017 at 12:53 AM | link

Carolyn - and a small detail is that professional firefighters annual cost about $330 per city resident, or $1000 for a household of 3.

And this is one of very few items where commuters do benefit from city's budget.

Another aspect of it is that with few high buildings in the city, you do want professionals- as opposed to 1-2 floor well separated suburban houses. And ESP is not the only high-rise in the area... Well, price of leaving in a 'real" city.

Bs - if you look at the table, school districts are responsible for more than 50% of taxes. And NYS is the highest in the nation for per-capita school spending - $20k/student every year. That is $240k per kid for 12 years in school. Who said college is expensive?

... said Mike on May 25, 2017 at 11:12 AM | link